Following the collapse of the bank he was running until earlier this year, Rodrigo Rato probably thought he would be able to slip into a quiet, if tarnished retirement.

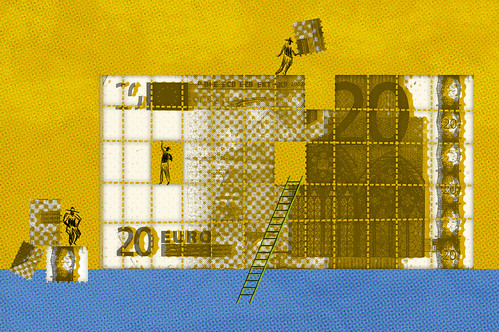

A former managing director of the IMF and minister of the economy during Spain’s boom years, Rato stepped down as executive chairman of Bankia in May after steering the group onto the jagged rocks of a €4.5b government bailout. Rato had bragged about the bank’s huge portfolio of loans and deposits, and it was floated with great fanfare on the stock exchange last summer. Within a year, however, buckling under the weight of a mountain of bad loans, the bank had had to be part-nationalised (for a description of how it happened, see this FT article). As well as institutional investors, hundreds of thousands of unwary Bankia customers and thousands of members of staff persuaded by their trade union that the stock was a safe investment found themselves out of pocket.

A few weeks after Rato’s resignation, his successor revealed that the net profit of €309m in 2011 that the bank had reported was in reality a €3b loss. The stricken entity would need an additional €19b bailout, and become the major trigger for the European Union rescue package announced by an embarrassed Spanish government earlier this month.

This latter revelation sparked the interest of Spain’s “indignados”, the loose association of young protesters who spent much of the middle part of 2011 camped out in the main squares of Spain’s biggest cities. The movement has been fairly quiet of late, but the Bankia debacle has roused it from its slumber. Deciding that Spain’s bankers had been getting away for too long with misleading the government, shareholders, customers and, well, everyone else, they took action.

The target was Rodrigo Rato, the idea to sue him and his colleagues for falsifying the firm’s accounts in the lead-up to the IPO. Having obtained support and crucial information on the board’s activities from a group of ten disgruntled shareholders, the indignados’ umbrella organisation 15-M needed to find €15,000 to meet the costs of filing the suit (the breakdown of those costs is detailed on the group’s website). Many of its members are unemployed, many others are students or low-paid workers. None had the means to take legal action single-handedly. What to do?

Ingeniously, they turned to crowdfunding to raise the money. Like its more famous cousin Kickstarter, the website goteo.org allows those in need to solicit funds from anyone who feels like contributing. In late May, therefore, as El País reports, 15-M began a Twitter campaign to drum up interest, under the hashtag #15MpaRato. At 9am on 5 June, the goteo.org page was launched. Within an hour it had received 11,000 visits. By 2pm it was in danger of crashing because of so many donations, and had to change servers. Within 24 hours, the fundraising target had been surpassed, with a total of €19,413 accumulated in donations of between €1 and €500. ‘Of every 40 attempts,’ reported a 15-M member based in Seville, ‘only one managed to make a successful donation.’

Rato and his colleagues will now have to stand trial, and the success of the fundraising effort has encouraged dozens of other Bankia shareholders to add their weight to the campaign. 15-M are seeking punishments of up to six years for those responsible for the bank’s demise, and preventive custody and an embargo on their assets in the meantime. In the pre-internet days, it would have taken months or years to raise the money to pursue such a case, but as one 15-M member remarked to Spain’s national TV station, with the power of crowdfunding, ‘fear has changed sides in the battle between those at the top and those at the bottom.’