In his autumn statement, George Osborne warned that, without his programme of fiscal consolidation, “Britain would have borrowed an additional hundred billion pounds in total [by 2014/15]. If we had pursued that path, we would now be in the centre of the sovereign debt storm.”

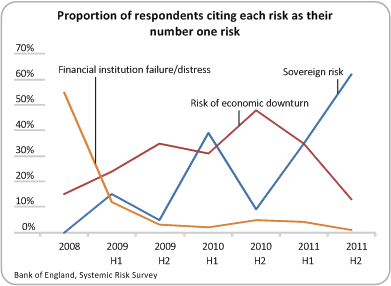

But how confident can we be that that storm has been averted? In the city, sovereign risk and an economic downturn are seen as the most important threats to the UK financial system. An economic downturn now seems more than likely, and will be savage if efforts fail to shore up the euro.

What about a sovereign debt crisis in the UK? When asked to name the most important current threat, risk managers for around 70 UK financial institutions now put debt at the top of their list.

I think they’re right to be worried. Even after this week’s downward revisions, the Office of Budget Responsibility expects tax revenues to grow rapidly over the next two financial years – but there’s little prospect of that happening if there’s a sharp downturn.

Imagine, instead, if the government’s income declined in the same way it did after 2008 – that would mean more than £150bn less revenue than expected over two years (a ‘taxation double dip’). Following the Chancellor’s logic, that would be enough to steer the UK straight into a debt storm.

Now you could argue that revenue will prove more robust than it did after 2008 and that’s probably true if the UK sees ‘normal’ economic underperformance. But euro breakup – accompanied by an inevitable banking crisis, massive disruption of exports, lower oil revenues etc. – would take us far beyond normal.

Bottom line: if the euro goes, it probably takes the British government with it. Happy days.

Update: Duncan Weldon has an IMF chart that shows the disproportionate contribution loss of tax revenues has made to driving up UK debt over the past four years.