It was a momentous weekend in Brussels, as the European Union struggled to get to grips with the latest episode in the long financial crisis.

Fascinating to see how close it all came to the wire. At midnight, journalists milling around outside the negotiating room were wondering whether “good-quality farmland in neutral, wealthy countries” would be the best place to stash their money if the Euro collapsed.

When the package was finally announced, they were astounded by its size. “We have numbers, and they are much larger than promised,” wrote the Economist’s Charlemagne at 3 am this morning. “We are in shock and awe territory here.” Markets have been duly impressed (it will be interesting to see if this holds as analysts dig into the fine print).

At best however, the deal is a stopgap . There’s been a consensus for months now that Greece will be unable to avoid an eventual restructuring of its debt (hopefully, a planned default). Many believe the same holds for some, or all, of the other PIGS (Ricardo Cabral for one, or Morgan Stanley’s Paolo Batori for another).

My question for Europe’s finance ministers – will you now get ahead of the curve on the Eurozone’s chronic problems, or are you going to drift towards another crisis?

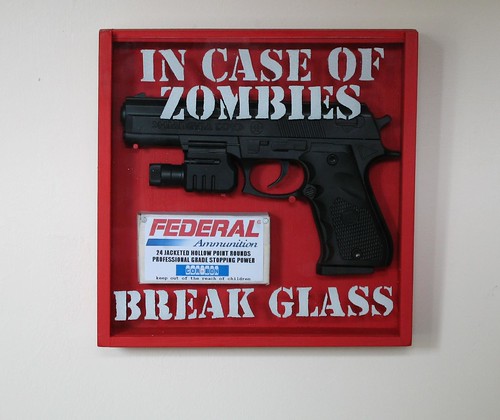

In the wake of Japan’s lost decade, it became fashionable for the British media to excoriate the Japanese government for failing to deal with its zombie banks (and the zombie companies on their balance sheets that had consigned the financial system to the realms of the living dead).

In 2002, the Economist bemoaned ‘the sadness of Japan‘:

From the Japanese government, there will be strenuous efforts to claim that reform is under way, that problems are being solved, that new measures are being considered. The claims will even be true, in a sense: there are plans aplenty, with stages and pillars and fine aspirations. But in a rather stronger sense they will be false: reforms are not being implemented, problems are not being solved, new measures are likely to make as little progress as the old ones. Japan is in a slow, so far genteel decline.

Perhaps the saddest thing is that there is nothing new about this. The turn in Japan’s fortunes began in 1990 with the crash in its stock and property markets, and then took firm hold in the mid-1990s when banks started to crumble and public borrowing lost its ability to keep the economy growing. As long ago as September 26th 1998, The Economist lamented on its cover about “Japan’s amazing ability to disappoint”.

But doesn’t Europe now have at least one zombie country in its midst- and possibly more (and zombie banks too, exposed to these countries’ debt)? And won’t the Eurozone continue to suffer almost indefinitely if it fails to take decisive action to take these countries through an orderly bankruptcy and get them back on a sustainable track?

(As an addendum, what about the UK? Could it become a zombie too? No. If markets stop funding British government debt, then the end will be swift. The IMF may ease the restructuring, but there’s no Eurozone for the UK to hide in. Relatedly, pre-election thoughts on how a Cameron-led government should deal with Europe, the economic crisis, and a volatile world.)